Blue Shield Contract with Stanford Hospital Expires; Negotiations Continue

Update 6/4/2018:

Good news from earlier today...Blue Shield just announced they have signed a new, multiyear contract with Stanford Health. From Blue Shield: "This means that Stanford Medical Center and its physicians are again part of Blue Shield's statewide network with no lapse as an in-network provider for contracted networks."

---------

Blue Shield of California and Stanford Health Hospital have been unable to come to agreement on a new contract. Effective May 1, 2018 (July 1, 2018 for some HMO members), Stanford Health will be considered an out of network provider for commercial Blue Shield HMO and PPO plans. Members who are actively being treated or have treatment scheduled within 180 days can request an exception under Continuity of Care guidelines (full details below). Lucille Packard Children's Hospital and Palo Alto Medical Foundation are unaffected.

Blue Shield members who have accessed affected providers within the last 12 months will be notified directly by Blue Shield via U.S. Mail.

Note: While not guaranteed, based on past contract negotiations, it seems likely that the contract status will be resolved, though that process may take weeks or months rather than days. In the meantime, our clients: you, your employees and their families are unfortunately caught in the middle of two behemoth health organizations in a fiscal fight.

This issue is not specific to Blue Shield, nor to Stanford Health. It is a function of the current U.S. health insurance structure, and its inherent lack of transparency. Contract negotiations and terms are not public (until they end/fail and the insurance carrier is required to notify affected members).

Our Allpointe team is available to answer your questions, your team's questions, and to assist any affected individual in obtaining continued care, or assessing their options, until this is resolved.

Full text of Blue Shield's announcement is below.

|

Weed is legal. Disclose your use on a life insurance application?

We typically write 20-30 term life policies annually for business owners and other high-net worth individuals, often as part of a buy-sell agreement or key person policy for our small business clients. Our general agency partner gives us access to a medical underwriting director with 25 years of experience, enabling us to match the right carrier with our client-specific needs and health/family history.

One new wrinkle is the legalization of recreational marijuana in California in 2018. How does a life insurance company looks at marijuana use? Here are a few examples from our medical underwriter:

Ex 1: 39 year old male, admits to smoking an occasional marijuana cigarette once a month. Urine specimen is negative for THC. All other underwriting criteria are standard or better. Case will likely be STANDARD (or better).

Ex 2: 28 year old male, does NOT admit to marijuana use on his application or insurance exam. Urine specimen is positive for THC. All other underwriting criteria are standard or better. Case will likely be RATED or DECLINED.

Ex 3: 54 year old male, history of chronic back pain controlled with medical marijuana obtained by prescription. No physical limitations and employed full time. No disability or extended time off from work. No other underwriting concerns. Case could be STANDARD or RATED.

(putting some jargon into understandable terms):

"Standard" = not great (3rd or 4th best risk class) = more expensive.

"Rated" = a LOT more expensive.

"Declined" = might get Standard or Rated sometime in the future, (but maybe not).

If you are thinking about taking advantage of one of California's new "green businesses," you may want to consider first locking in a 20- or 30-year term life policy. Once in place, you will then be truly free to choose whether to use.

ALERT: Wages put into commuter benefits no longer an employer deduction.

Wait, what? Yes, you have to read that carefully. Check out the complete explanation from our friends at WageWorks. This is a 2018 little-mentioned change as a result of the Tax Cuts and Job Act (HR 1).

The employee still receives an income tax deduction on the dollars they voluntary put aside for commute-related public transit and parking. And the employer does not have to pay FICA on those funds. But the employer cannot also deduct those same wage dollars as a normal business expense.

WageWorks offers a clear example and deeper explanation here.

Our take: offering pre-tax commuter benefits is still a great (and often required) part of any employer benefit package. But the change will disproportionately affect smaller businesses, that are less likely to reap the full benefits of other business tax cuts that were part of HR 1.

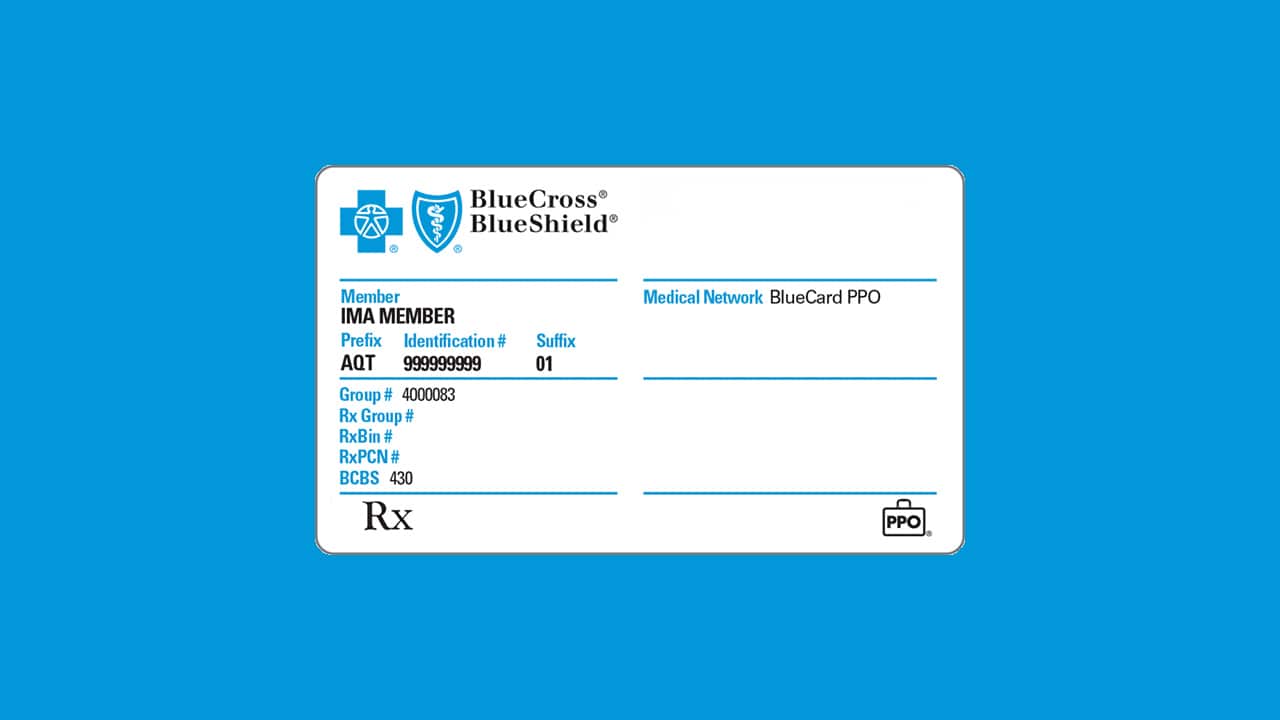

Accessing the BlueCard PPO network outside of California

For our clients who are covered on a small business PPO plan from Anthem Blue Cross or Blue Shield of California, your network of providers extends nationwide through the BlueCard program while traveling outside of CA - or if you are based in another state. This includes those enrolled with Anthem or Blue Shield via an exchange: CalChoice or Covered CA for Small Business.

To find coverage with out of state providers, go here from any web browser.

From the big blue box in the middle of the screen, select “In the United States, Puerto Rico, and US Virgin Islands” for your location.

Enter your location (city, state or zip) and plan

Under the “Your Plan” drop down menu, you can either enter the number from your medical ID card or you can “Select by Plan Name"

The plan name to choose from the list is BlueCard PPO Basic

Feel free to reach out to us at Allpointe with any questions or if you would like any assistance. We are here to bridge the gap between you and the insurance company so please don’t hesitate to call or email us!

Sutter & Health Net agree on new contract and Blue Shield contract expires

As the clock ticked down the last hours of 2016, Health Net and Sutter Health were able to come to agreement on an extension of their current contract, extending Sutter Health's in-network status for most Health Net plans.

With the turn of the calendar to 2017, the contract between Sutter and Blue Shield of CA has expired, although the two health giants continue to negotiate. Full text of notifications from the carriers are posted below.

From Health Net senior account executive (12/30/2016):Read more

Blue Shield of CA Switching to CVS for Pharmacy Management

Blue Shield recently notified policyholders of the upcoming change to their pharmacy network benefits. The details in full are outlined below. Please review, and contact Allpointe if you have questions about how this may affect your pharmacy coverage. The change will take effect January 1, 2017 regardless of when your plan renews.

Blue Shield has entered into an agreement with CVS Health to support manufacturer rebate and pharmacy network contracting for the outpatient pharmacy benefit, which has been approved by the Department of Managed Health Care.

CVS Health will manage Blue Shield's national retail pharmacy network, and become our exclusive mail order pharmacy for Commercial and Medicare plans and our specialty pharmacy for Commercial plans, starting January 1, 2017.

This new agreement will enable us to leverage CVS Health’s purchasing power and reduce pharmacy costs. It will allow us to offer more competitive pharmacy products while continuing in our commitment to provide access and convenience for our members.

Who is affected?

The new pharmacy network changes will apply to all Blue Shield lines of business:

- Commercial

Premier, Core, Small Business, Individual and Family Plans (IFP) and Self-Funded/Administrative Services Only (ASO) - Medicare

Individual and Group Medicare Advantage and Prescription Drug plans

Pharmacy network changes that will affect how our members access their benefits at the retail, mail order and specialty pharmacy will become effective January 1, 2017. Impacted members will be notified 60 days in advance of these changes by mail and telephone.

What are the pharmacy network changes?

There are three areas that will be affected by these changes. The member impact for most of these changes are relatively minimal and are as follows:

- Retail pharmacy

CVS Health will support Blue Shield’s retail network contracts. The Blue Shield network retail pharmacies will be nearly unchanged and will continue to include all key chains such as CVS, Walgreens, Rite-Aid, Costco and many others. The vast majority of our members will continue to have the same convenient access to network pharmacies near where they live and work. In fact, the network pharmacies with preferred cost-sharing will expand to include additional national retail pharmacies. Please refer to the for more information.

- Mail order pharmacy

Blue Shield will transition from current mail order pharmacy, PrimeMail, to CVS Health mail order pharmacy.

- Specialty pharmacy

Currently, Blue Shield’s commercial specialty network includes two vendors, CVS/Caremark and Walgreens Specialty, with the majority of specialty prescriptions filled by CVS/Caremark. With the agreement, CVS/Caremark will become our exclusive specialty pharmacy for Commercial plans. Members shall continue to have the convenient access to pick up their specialty medications at a local retail CVS pharmacy. Medicare plans will continue to have an open specialty pharmacy network, which includes Walgreens Specialty and CVS/Caremark.

Transition plan

Blue Shield Pharmacy Services has been working with CVS Health to develop an implementation plan that ensures a smooth transition. As part of the plan, members who may be affected by these changes will be notified 60 days in advance of the January 1effective date.

- For retail

Letters will be sent to impacted members, which will provide information on up to four network pharmacies (two based on the member’s address on file and two based on the terming pharmacies address).

- For specialty and mail order

Letters will be sent to impacted members. Members will also receive CVS Health Welcome Kits.

- Active specialty and mail order prescriptions

For prescriptions that have active, remaining refills, Blue Shield will work with PrimeMail (mail order) and Walgreens Specialty (for specialty drugs) to transfer members’ remaining refill prescriptions to CVS/Caremark. Member payment information, such as credit card details, will not be transferred. Members will need to register with CVS/Caremark to provide this information. CVS will conduct a call campaign to these members to assist with registration.

- Non-transferable drugs

Some selected drugs are not eligible for transfer, such as Schedule 2 prescriptions. Since Federal law doesn’t allow refills for Schedule 2 prescription drugs, members using such drugs will have to visit their provider to get new prescriptions for each fill, even when using mail order.

Blue Shield of CA and Sutter Health: Negotiating a new contract

From Blue Shield today....

Blue Shield and Sutter Health are engaged in contract negotiations

Blue Shield of California and Sutter Health are engaged in discussions on rates and terms for a new network contract (HMO/PPO and in some cases, Group Medicare Advantage). The current contract is set to expire at the end of this year and without a new deal, Sutter Health would no longer be a Blue Shield in-network provider starting January 1, 2017

We are working diligently in good faith to complete a new contract that is fair and sustainably affordable for our customers. If the network relationship terminates, Blue Shield will ensure that members have continued access to care in their area, including continuity of care for those who qualify to continue in their current course of treatment with a Sutter Health provider.

What are the lines of business affected by the negotiations?

The contracts being negotiated apply to all Blue Shield plan types, including HMO, PPO, EPO, POS-HMO Tier, POS-PPO Tier and Group Medicare Advantage.

- Individual and Family Plans: Grandfathered and Non-Grandfathered Plans (on and off exchange)

- Medicare: Group Medicare Advantage Prescription Drug (GMAPD) plans

- Small Business (1-100 employees)

- Fully Funded Large Employers (101+ employees)

- Self-Funded/ASO Large Employers (101+ employees)

- Self-Funded/Shared Advantage (101+ employees)

- CalPERS

- FEP

- FEHBP

Sutter Health providers are located in Northern and Central California (see listing of counties below). In addition, Sutter Health has surgery centers in San Diego County.

| Sutter Health Counties | ||||

| Alameda | Marin | San Joaquin | Santa Cruz | Sutter |

| Amador | Merced | San Luis Obispo | Shasta | Yolo |

| Contra Costa | Placer | San Mateo | Solano | |

| Del Norte | Sacramento | Santa Barbara | Sonoma | |

| Lake | San Francisco | Santa Clara | Stanislaus | |

The contracts currently being negotiated include the following Sutter Health hospitals:

- Alta Bates Medical Center Herrick Campus

- Alta Bates Summit Medical Center Alta Bates Campus

- California Pacific Medical Center - California Campus*

- California Pacific Medical Center - Pacific Campus*

- California Pacific Medical Center - St Luke's Campus*

- California Pacific Medical Center Davies Campus*

- Eden Medical Center

- Memorial Hospital Medical Center

- Memorial Hospital of Los Banos

- Menlo Park Surgical Hospital

- Mills Peninsula Health Center

- Mills Peninsula Medical Center

- Novato Community Hospital

- Sutter Amador Hospital

- Sutter Auburn Faith Hospital

- Sutter Center for Psychiatry

- Sutter Coast Hospital

- Sutter Davis Hospital

- Sutter Delta Medical Center

- Sutter Lakeside Hospital

- Sutter Maternity and Surgery Center of Santa Cruz

- Sutter Medical Center of Santa Rosa

- Sutter Medical Center, Sacramento

- Sutter Roseville Medical Center

- Sutter Solano Medical Center

- Sutter Surgical Hospital North Valley

- Sutter Tracy Community Hospital*Includes Medicare Advantage

In the event of a termination with Sutter and in accordance with DMHC regulations, Blue Shield of California would notify HMO members assigned to a Sutter Health Primary Care Provider (PCP) 60-days in advance of a potential termination with Sutter Health. PPO members with an out-of-network benefit could receive services from a Sutter-affiliated provider, but the out-of-pocket costs will be at the non-preferred benefit level.

Our commitment to affordably priced health coverage

Blue Shield continues its provider contract discussions with Sutter Health in hopes that new agreements will soon be reached. We appreciate your patience while we work to secure the best possible outcome for our customers and members. Our goal is to provide our members with access to quality health care at an affordable price.

Emergency services

Blue Shield of California members who need emergency services should call 911 or seek care at the nearest emergency room. Blue Shield will provide the full emergency care level of benefits for these services.

Friends of the Urban Forest: Potrero Hill Neighborhood Planting 8/27/16

Friends of the Urban Forest has funding to subsidize up to 75% of the costs to plant trees. They handle all of the prep work, provide the tree, and do the scheduled tree care visits over the first three years of the tree's life to help it thrive! If you are a property owner in Potrero Hill and would like to infuse your concrete sidewalk with a little green, contact FUF before July 20th, 2016 to reserve your tree. You can also call Kyle at 415-268-0772.

The community planting day is scheduled for August 27, 2016.

Support local artists - join us at TASTE 2016

Today is the last day to buy discounted tickets to this art and culinary extravaganza.

Some crazy cool perks for our Host and VIP level guests...Smitten Ice Cream is making made-to-order ice cream with liquid nitrogen and Recchiuti Confections is coming by to do Chocolate Spin-Art demos!

#RDartist Cayla Harris designed this year's VIP tote that comes with some fun stuff from 3 Fish Studios, ARCH Art & Drafting Supply, and San Francisco Magazine (to name a few).

San Francisco HCSO 2015 reporting deadline: Extended to May 2nd

The City of San Francisco's Office of Small Business just sent a reminder: you must file your Health Care Security Ordinance (HCSO) report for 2015, by April 30, 2016 or face a $500/quarter late filing fee.

Note: Private employers who employed fewer than 20 employees for all of 2015 (or non-profit employers that employed fewer than 50), do not need to file. Stop here.

.Pdf preview of data required to file

If you are filing for the first time, or need assistance collecting data or running reports, please contact Allpointe as soon as possible so that we can help you in advance of the deadline.

Can an employer reimburse employees for individual health plans?

In short, no.

This used to be a grey area in the tax code (although there were always potential issues with the Department of Labor). But recent rulings from the IRS and the DOL have made it very clear that this cannot be done on any sort of pre-tax basis.

Potential penalties? $36,500. Per year. Per employee.

And the use of a Health Reimbursement Arrangement (HRA) to reimburse premiums tax-free? Also no good.

Anthem Blue Cross and Stanford Health resolve impasse

11/20/2014 UPDATE:

We have learned that the contract resolution does NOT apply to 2014 and later Anthem individual and family plans with the Pathway and Pathway X PPO or EPO networks. This is officially bad news for Anthem individual clients. The Lucille Packard Children's Hospital is included in both networks (Tier 2 hospital in the EPO).

..........

Chris Rauber at the SF Business Times reported the news yesterday.

The new deal is retroactive to Sept. 8, "and Anthem will work with Stanford to reprocess claims for services provided during the period that the contract had lapsed," both sides said in a joint Nov. 12 statement.

The deal is reportedly for three years and applies to individual and small business plans, as well as large group and Medicare plans.