Simple, easy, affordable access to legal services

What's this? Membership provides you and your family an attorney's services for common (and uncommon) legal needs.

How much does it cost? $29.95/month covers you (and your spouse or partner)

What kind of services are included?

- Will preparation

- Living will (medical directive)

- Durable power of attorney

- Traffic ticket defense

- IRS audit services

- Family law - representation for uncontested divorce, separation, adoption, name changes

- 24/7 emergencies - detained by authorities, traffic accident

- More details

Ok I’m interested… what next? Click here to get connected with our LegalShield partner.

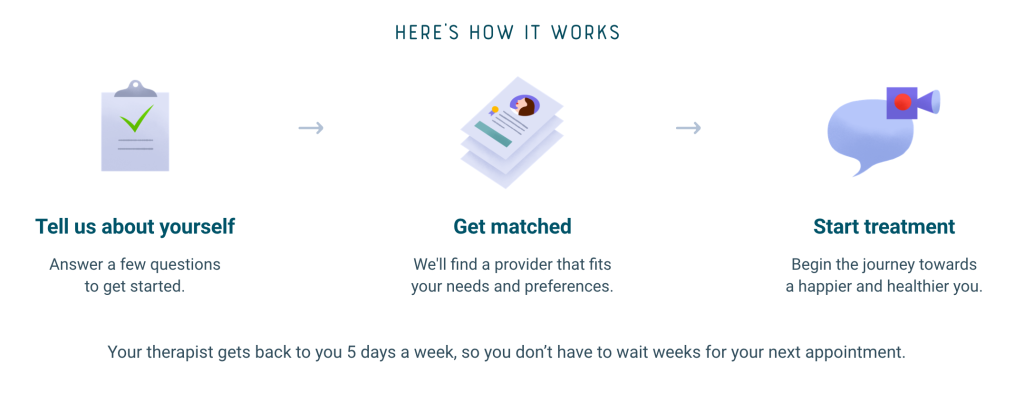

Talkspace: text- and video-based therapy

What's this? Online therapy with a licensed therapist, matched to fit your specific needs and preferences.

How does it work?

How much does it cost? Plans start at $65 per week, with unlimited messaging support and options for weekly video calls. Save 25% on your initial subscription with the discount code: allpointe. Click here to get started.

Kaiser to cover cost of COVID-19 rapid antigen home tests

While other carriers are still scrambling to respond to the federal mandate to cover up to 8 at-home rapid antigen tests per covered family member, per month, Kaiser is the first to provide complete guidance as of January 17th. From Kaiser:

The highly contagious omicron variant continues to spread throughout our communities. Vaccination and boosters provide the best protection against severe illness from COVID-19. Testing is also an important tool in slowing the spread of COVID-19. While Kaiser Permanente has provided over 68,000 daily tests, demand currently exceeds capacity. Rapid antigen home tests, also called rapid COVID tests or self tests, offer another way to help reduce the spread. Health plans are now reimbursing membes for these at-home tests.

Kaiser Permanente to cover cost of COVID-19 rapid antigen home tests

Following guidance from the Biden administration, Kaiser Permanente will now reimburse members for FDA-approved rapid antigen home tests. Members can submit a reimbursement claim for tests purchased on or after January 15, 2022.

Currently, there is a nationwide shortage of rapid antigen home tests. Kaiser Permanente, like other health care organizations, has access to a very limited supply of tests. We are working to get tests and make them available to our members through a number of outlets, including mail-order. We will share details as they become available.

How to get FDA-approved rapid antigen home tests

- Starting January 19, members can request free rapid antigen home tests, without shipping fees, from the federal government.[https://www.covidtests.gov/]

- Rapid antigen home tests are also available at local drugstores or online. Kaiser Permanente will reimburse members for FDA-approved rapid antigen home tests purchased on or after January 15th.

- In the coming days, as supply of tests increases, we will make more rapid antigen home tests available to members. Visit KP.org for the most up-to-date information on supply, testing, and vaccinations.

Guidance on types of COVID-19 tests

Rapid antigen home tests are a fast, easy way to get a quick result if members have symptoms, think they have been exposed to someone with COVID-19, or plan to gather indoors with those who may be at risk including unvaccinated children, older individuals, and those who are immunocompromised. Results are typically available within 30 minutes. https://www.fda.gov/medical-devices/coronavirus-disease-2019-covid-19-emergency-use-authorizations-medical-devices/in-vitro-diagnostics-euas-antigen-diagnostic-tests-sars-cov-2

PCR tests are usually processed in a lab and results are typically available in 1-3 days. At Kaiser Permanente, PCR tests are required for members who are coming in for certain clinical procedures that require a negative test in advance. For more detail, visit our COVID-19 testing FAQs. https://healthy.kaiserpermanente.org/health-wellness/coronavirus-information/testing#faqs

Kaiser Permanente is committed to the safety of our members, care teams, and communities. We will get through this challenging time, together.

COBRA Developments (tl;dr)

Remote Life Resources

We came across this terrific list -- a public, collaborative resource maintained by our partners at Justworks.

Great ideas and links, organized into categories:

- Virtual fitness

- Activities for kids

- Structuring your day

- Keeping your mind active

- Virtual outings

- How to help others

Check it out, and submit your own great idea or resource to keep the list growing!

Interested in Justworks for your small business payroll and HR needs? Let us know.

Cafeteria Plan Developments: DOL Black Hole Deadline Extension

By: David LeFevre, ERISA Attorney + Chief ERISA Geek, ERISAfire Benefits Compliance Solutions

This post examines the cafeteria plan implications of DOL’s black hole ERISA deadline extension. For other analyses, see this post on mid-year election change developments from the IRS, this post on a temporary relaxation of the grace period rules, this post on an increase in the maximum allowable carryover, this post on the repeal of the prescription requirement for over-the-counter items, and this post on HSA implications of recent telemedicine developments.

On its own volition, DOL created a black hole period that cannot be used in counting any days in certain deadline periods. Be aware that the guidance applies broadly to ERISA, COBRA and HIPAA special enrollment, but this analyst report focuses on the cafeteria-plan related aspects.

Current Rule

For cafeteria benefits subject to ERISA—which includes limited-purpose healthcare FSA, general-purpose healthcare FSA and pretax deductions for medical, dental, vision, life, disability, etc., but not dependent care FSA/DCAP—ERISA requires that claims and appeals be administered according to certain standards. Claimants must have a reasonable amount of time to submit initial claims. The claim reviewer must decide those claims within a certain amount of time. Claimants must be given a minimum amount of time to submit appeals if the initial claim is denied, and they must be given a certain amount of time to submit additional documents or evidence to support an appeal.

Consistent with ERISA, most healthcare FSAs have a 60-, 90- or 120-day claims run-out period following the end of the plan year within which to submit the claims they have incurred. (This is different than a grace period, which allows additional time to incur new claims.) Claimants are usually given 180 days after a claim is denied to submit a formal appeal.

New Rule

If a claims or appeals submission deadline falls on a date that is inside the DOL’s black hole period, then the deadline is automatically extended by disregarding any days in the black hole period. The black hole period is significant. It starts March 1, 2020, and lasts through the 60th day after the end of the COVID-19 national emergency declaration expires, or 60 days after such other date as DOL announces. As of the date of this analyst report, neither DOL nor the President nor any members of Congress have indicated the anticipated expiration date of the national emergency declaration, though under ERISA Section 518, the black hole period is limited to one year.

This has big implications for healthcare FSAs. If a calendar-year healthcare FSA has a claims run-out period—that is, a claims submission deadline—of March 30, 2020, then the entire period from March 1, 2020, through the black hole end date (which we’ll assume for argument’s sake is July 29, 2020) is disregarded. That doesn’t mean the deadline is now July 30, 2020. Remember, the entire month of March was disregarded, so the 30 days between March 1 and March 30, 2020, get added to the end of the black hole period, and the new claims submission deadline for 2019 claims is now August 28, 2020.

The same will be true of fiscal-year cafeteria plans with claim or appeal submission deadlines that fall during the black hole period. If a fiscal-year healthcare FSA with a plan year end of April 30, 2020, has a claims run-out period—that is, a claims submission deadline—of June 30, 2020, then the entire period from the first day after the plan year, May 1, 2020, through the black hole end date (assuming, again, that it is July 29, 2020) is disregarded, and the new claims submission deadline for 2019 claims is now October 27, 2020.

Plan Amendment Requirements

A plan amendment will be required, and unfortunately, there is no choice in the matter. The extension of deadlines happens by operation of law, and ERISA requires that the plan documents contain claims and appeals deadlines, or at least a mechanism for determining what they are.

Considerations

First, take a deep breath. It’s bad, but it may not be as bad as you think. (The implications for medical benefits and COBRA are way worse, if it’s any consolation.) It may seem like this black hole period makes it impossible to determine carryover amounts for plans with carryover features, and to some extent that is true, but there will be a limited practical effect.

Take, for example, a calendar-year healthcare FSA with a carryover feature. Say someone elected $2,500 in 2019 and submitted $2,000 in claims. $500 gets rolled over. In June of 2020 the participant files a $50 claim that was incurred in 2019. It gets paid, and the third-party administrator pays the claim from the $500 carryover funds. Carryover balance is $450; rest of 2020 election remains.

The math is the same if the carryover is retroactively adjusted because of DOL’s black hole period. Say someone elected $2,500 in 2019 and submitted $2,000 in claims. $500 gets rolled over. In June the participant files a $50 claim from 2019. The carryover is adjusted to $450; rest of 2020 election remains. For participants who did not forfeit any balances from the 2019 plan year, it’s a wash.

The real impact of the DOL’s black hole period will be on participants who forfeited healthcare FSA funds from 2019. In our calendar-year carryover example, say someone elected $2,500 in 2019 and submitted $1,500 in claims. $500 gets forfeited; $500 gets rolled over and is added to the participant’s $2,500 2020 election. In June of 2020 the participant files a $50 claim from 2019. It gets paid, and the third-party administrator pays it out of the $500 carryover. The carryover balance is $450. The participant then submits $3,000 in 2020 claims. The third-party administrator denies the last $50, but under the DOL black hole guidance, that should not have been the result. Instead, the $50 claim from 2019 should have been paid out of the $500 in forfeitures and not the carryover amount.

The same will be true of cafeteria plans with grace period features and cafeteria plans with neither grace period nor carryover features. Forfeitures will have to be held in suspense until the end of the black hole period is determined and any black hole days are tacked on to the end. Then, employers have a few options.

Hopefully the employer’s third-party administrator will have a mechanism for paying 2019 claims of participants who forfeited healthcare FSA funds. Ideally, the third-party administrator would manually or automatically catch claims filed with prior-year dates of service or purchase and cross-check them with the list of folks with forfeitures.

Alternatively, if that’s not an option, the third-party administrator could provide the employer a list of claims it denied because of dates of service or purchase from the prior plan year so that the employer can make the reimbursement (to the extent of the person’s forfeitures) either by an after-tax payroll expense reimbursement or by check.

Concluding Thoughts

There are a great many possibilities presented by these regulatory and legislative changes. Employers are urged to proceed carefully. With respect to changes that are not mandatory, be principled in whether and how to implement any of these changes, and make sure the changes are well-documented. If there is not a good case to be made for a particular change, it may be best to wait before making it.

About ERISAfire

ERISAfire LLC is an employee benefits compliance services firm, specializing in health and welfare benefits. ERISAfire has reimagined benefits compliance to help agencies and employers manage compliance risks and make the process easier. By leveraging custom-built technology to automate transactional tasks and provide a hyper-customized compliance calendar, its ERISA geeks can focus on complex analysis and experienced ERISA attorneys can scrutinize even the most mundane compliance tasks. Learn more at www.erisafire.com.

Cafeteria Plan Developments: Telemedicine

By: David LeFevre, ERISA Attorney + Chief ERISA Geek, ERISAfire Benefits Compliance Solutions

This post examines health savings account (HSA) and high-deductible health insurance (HDHP) implications of recent telemedicine developments. For other analyses, see this post on mid-year election change developments from the IRS, this post on a temporary relaxation of the grace period rules, this post on an increase in the maximum allowable carryover, this post on the repeal of the prescription requirement for over-the-counter items, and this post on cafeteria plan implications of DOL’s black hole ERISA deadline extension.

Current Rule

Under Code Section 223, a person is eligible to make contributions to an HSA only if the person is covered by a high-deductible health plan and has no disqualifying coverage. Any coverage of medical care or expenses inside the HDHP deductible for which the person does not pay (or pays less than fair market value) is disqualifying coverage (e.g. employer-paid telemedicine, general-purpose healthcare FSA coverage, on-site clinics with no cost-sharing, HRA coverage, coverage under a spouse’s employer’s plan or FSA, etc.).

New Rule

The recently enacted CARES Act amended Code Section 223 to deem telemedicine not disqualifying coverage for plan years beginning prior to December 31, 2021. For calendar year plans, this would apply to the 2020 and 2021 plan years. In addition, a HDHP will not fail to qualify as a HSA-qualified HDHP if it does not apply the deductible to telemedicine services. This statutory change applies to all telemedicine, not just COVID-19-related services.

Plan Amendment Requirements

Insofar as an individual receives telemedicine services outside of a HDHP, he/she will remain HSA-eligible by mere operation of law without need for any cafeteria plan amendment. However, adding telemedicine services to a HDHP that are provided without cost-sharing and before meeting the plan’s deductible is a plan design change to the HDHP that will require an amendment to the insurance policy or self-insured summary plan description.

About ERISAfire

ERISAfire LLC is an employee benefits compliance services firm, specializing in health and welfare benefits. ERISAfire has reimagined benefits compliance to help agencies and employers manage compliance risks and make the process easier. By leveraging custom-built technology to automate transactional tasks and provide a hyper-customized compliance calendar, its ERISA geeks can focus on complex analysis and experienced ERISA attorneys can scrutinize even the most mundane compliance tasks. Learn more at www.erisafire.com.

Cafeteria Plan Developments: Over-the-Counter Items

By: David LeFevre, ERISA Attorney + Chief ERISA Geek, ERISAfire Benefits Compliance Solutions

This post examines recent legislation that repealed the ACA’s requirement that healthcare FSA participants have a prescription for over-the-counter items and feminine hygiene products. For other analyses, see this post on mid-year election change developments from IRS, this post on a temporary relaxation of the grace period rules, this post on an increase in the maximum allowable carryover, this post on HSA implications of recent telemedicine developments, and this post on cafeteria plan implications of DOL’s black hole ERISA deadline extension.

Current Rule

The Affordable Care Act amended Code Sections 106 and 213(d) to limit qualified expenses for general-purpose healthcare FSAs and HRAs so that a prescription was required for any over-the-counter medicines or feminine hygiene products.

New Rule

The recently-enacted CARES Act allows employees to use their healthcare FSA dollars for over-the-counter medicines and feminine hygiene products without a prescription. Employer-provided HRAs may also reimburse for over-the-counter medicines and feminine hygiene products without a prescription. This change took place once the Act was passed and was applied retroactively to January 1, 2020. Therefore, employees can submit expenses for reimbursement if over-the-counter or feminine care products were purchased on or after January 1, 2020.

Plan Amendment Requirements

Depending on how the plan defines “qualified expenses,” this change may be automatic, or it may require a plan amendment. Most cafeteria plans include a provision that expressly requires a prescription for over-the-counter medicines, and a plan amendment will be required to eliminate that provision.

Considerations

An employer considering this expansion of permissible expenses should ensure that its third-party administrator has the capability to implement the change, and, if so, confirm the timing of any system changes so that the employer does not prematurely notify employees.

About ERISAfire

ERISAfire LLC is an employee benefits compliance services firm, specializing in health and welfare benefits. ERISAfire has reimagined benefits compliance to help agencies and employers manage compliance risks and make the process easier. By leveraging custom-built technology to automate transactional tasks and provide a hyper-customized compliance calendar, its ERISA geeks can focus on complex analysis and experienced ERISA attorneys can scrutinize even the most mundane compliance tasks. Learn more at www.erisafire.com.

Cafeteria Plan Developments: Increase in Maximum Carryover

By: David LeFevre, ERISA Attorney + Chief ERISA Geek, ERISAfire Benefits Compliance Solutions

This post examines recent IRS guidance that increases the maximum allowable carryover amount for healthcare FSAs. For other analyses, see this post on mid-year election change developments from the IRS, this post on a temporary relaxation of the grace period rules, this post on the repeal of the prescription requirement for over-the-counter items, this post on HSA implications of recent telemedicine developments, and this post on cafeteria plan implications of DOL’s black hole ERISA deadline extension.

Current Rule

Ordinarily, contributions to healthcare FSAs must be spent by the end of the plan year or else they are forfeited. However, pursuant to IRS Notice 2013-71, in lieu of a grace period, plan sponsors can design the healthcare FSA to permit up to $500 of unused healthcare FSA funds to carry over, or roll over, to the following year. The $500 limit on carryovers was not indexed for inflation.

For a calendar-year healthcare FSA, if the plan sponsor included a carryover provision in its cafeteria plan, a participant with $600 remaining at the end of 2020 could carry over $500 to 2021, forfeiting the remaining $100.

New Rule

IRS Notice 2020-33 increases the maximum allowable carryover amount to 20 percent of the maximum salary reduction contribution under Code Section 125(i). The new formula can be used starting with plan years beginning in 2020 for amounts carried over to plan years beginning in 2021.

The maximum healthcare FSA salary reduction contribution for 2020 is $2,750, so the maximum allowable carryover from 2020 to 2021 is equal to 20 percent of $2,750, or $550.

Plan Amendment Requirements

The new carryover maximum is not automatic; a cafeteria plan must be amended to incorporate the new inflationary mechanism for carryovers. For plans that already have a carryover provision or that have neither a carryover nor grace period provision, the amendment may be retroactive to January 1, 2020, and must be adopted by December 31, 2021.

For plans that currently have a grace period provision, the amendment cannot be retroactive. The plan’s current grace period is essentially a protected form of benefit that cannot retroactively be taken away. The grace period feature must first be eliminated on a prospective basis—that is, the grace period that extends the current plan year’s period for incurring new claims must be allowed to run its course—and then the carryover feature can be added to the following plan year, allowing carryovers from 2021 to 2022.

Considerations

If an employer does want to take advantage of the increase in maximum allowable carryover, it should ensure that its third-party administrator has the capability to implement the change, and, if so, confirm the timing of any system changes.

About ERISAfire

ERISAfire LLC is an employee benefits compliance services firm, specializing in health and welfare benefits. ERISAfire has reimagined benefits compliance to help agencies and employers manage compliance risks and make the process easier. By leveraging custom-built technology to automate transactional tasks and provide a hyper-customized compliance calendar, its ERISA geeks can focus on complex analysis and experienced ERISA attorneys can scrutinize even the most mundane compliance tasks. Learn more at www.erisafire.com.

Cafeteria Plan Developments: Relaxation of Grace Period Rules

By: David LeFevre, ERISA Attorney + Chief ERISA Geek, ERISAfire Benefits Compliance Solutions

This post examines recent IRS guidance that temporarily relaxes the grace period rules for healthcare FSAs and dependent care FSAs (aka dependent care assistance programs or DCAPs). For other analyses, see this post on mid-year election change developments from IRS, this post on an increase in the maximum healthcare FSA carryover, this post on the repeal of the prescription requirement for over-the-counter items, this post on HSA implications of recent telemedicine developments, and this post on cafeteria plan implications of DOL’s black hole ERISA deadline extension.

Current Rule

Ordinarily, contributions to healthcare FSAs and dependent care FSAs/DCAPs must be spent by the end of the plan year or else they are forfeited. However, plan sponsors may establish a grace period of no more than 2 1/2 months after the end of a plan year (technically, two months and 15 days) to incur new claims that can be paid from contributions made in the plan year immediately preceding the grace period.

For a calendar-year plan, if the plan sponsor included a grace period in its cafeteria plan document, claims incurred between January 1, 2020, and March 15, 2020, can be paid from the employee’s 2019 healthcare or dependent care FSA balance. For a fiscal-year plan ending June 30, 2020, for instance, if the plan sponsor included a grace period in its cafeteria plan document, claims incurred between July 1, 2020, and September 15, 2020, can be paid from the employee’s 2019-20 healthcare or dependent care FSA balance.

Alternatively, for healthcare FSAs (but not dependent care FSAs/DCAPs), plan sponsors may opt for a carryover feature under which up to $500 in unused healthcare FSA contributions may be carried or rolled over from one year to the next. Current rules do not allow both a grace period feature and a carryover feature for the same healthcare FSA plan year.

New Rule

IRS Notice 2020-29 establishes a temporary extension of the maximum allowable time to incur new claims that may be paid with prior-year balances for healthcare FSAs (both general-purpose and limited-purpose) and dependent care FSAs. The temporary extension is optional, and it is available to FSAs with grace periods or plan years ending in 2020. The temporary extension allows new claims to be incurred between January 1, 2020, and December 31, 2020. The precise effect it can have on a cafeteria plan will vary greatly depending on its plan year and its grace period or carryover features.

Calendar-Year Cafeteria Plans

For calendar-year healthcare FSAs with carryover features, there is no benefit. To take advantage of the temporary extension, the new guidance requires there to be a plan year or grace period ending in 2020. The 2019 plan year won’t have had a grace period that ends in 2020 because carryovers and grace periods are mutually exclusive. The plan year itself is the only element ending in 2020 for a calendar-year healthcare FSA with a carryover feature, so the added value is nil because the carryover ends the same day as the temporary extension ends.

For calendar-year healthcare and dependent care FSAs with a grace period feature, the new IRS guidance essentially allows employers to extend the grace period to December 31, 2020, permitting employees to incur new claims through December 31, 2020, and be reimbursed from their 2019 balances.

For calendar-year healthcare and dependent care FSAs with neither a grace period nor a carryover feature, there is no benefit. The new guidance requires there to be a plan year or grace period ending in 2020, and the only thing ending in 2020 is the 2020 plan year, which ends on the same date as the end of the temporary extension, so there's nothing to take advantage of under the new guidance.

Fiscal-Year Cafeteria Plans

There may be more benefit for fiscal-year plans. Consider a July 1 to June 30 fiscal-year cafeteria plan.

For a fiscal-year healthcare FSA with a carryover feature for 2019-20 that allows $500 to roll over to 2020-21, there will be a benefit for participants with account balances at the end of the 2019-20 plan year that exceed $500. To take advantage of the temporary extension, the new guidance requires there to be a plan year or grace period ending in 2020. In this case, there is no grace period ending in 2020 because grace periods and carryovers were mutually exclusive when the 2019-20 plan design was established, but the 2019-20 plan year does end in 2020, and so a temporary extension of the maximum allowable time to incur new claims can be added, allowing claims incurred through December 31, 2020, to be paid from the 2019-20 balance.

Remember, though, the $500 that is carried over from 2019-20 to 2020-21 can be spent on claims incurred all the way through June 30, 2021, in this example, so the extension to December 31, 2020, will only help people who would have otherwise had forfeitures because their balances at the end of the 2019-20 plan year exceeded $500.

For a fiscal-year healthcare or dependent care FSA with a grace period feature, both the plan year and the grace period end in 2020, so the plan can be amended to allow claims to be incurred through December 31, 2020, and be reimbursed from the 2019-20 balance. This is essentially just an extension of the 2019-20 grace period through December 31, 2020.

For a fiscal-year healthcare or dependent care FSA that has neither a grace period nor a carryover feature, there is a plan year that ends in 2020 (June 30, 2020, in this example), so an extended grace period can retroactively be added to the 2019-20 plan year, and the grace period can run up through December 31, 2020.

Plan Amendment Requirements

This temporary extension of the maximum allowable time to incur new claims is not automatic; a cafeteria plan must be amended to allow it. The amendment may be retroactive to January 1, 2020, and it must be adopted by December 31, 2021.

Considerations

If an employer does want to take advantage of the temporary extension of the maximum allowable time to incur new claims, it should ensure that its third-party administrator has the capability to implement the change, and, if so, confirm the timing of any system changes so that the employer does not notify employees of the change only to have their claims auto-adjudicated and denied.

Coordination with the third-party administrator is even more important if the employer is changing third-party administrators. For FSAs that have had grace periods in the past, it was not uncommon for the administrative services contract to include a run-out period for those claims. However, when the run-out period in that contract was negotiated, a year-long grace period was not contemplated, and so it is likely the run-out period will not be long enough. Arrangements will need to be made with the new third-party administrator to adjudicate claims made on prior-year balances.

If the period for incurring new claims is extended for a general-purpose healthcare FSA, the employee will be ineligible to make contributions to a health savings account (HSA) until the first of the month following the end of the extension. This means that if the period for incurring new claims is extended to December 31, 2020, someone who has a balance as of December 31, 2019, in his/her general-purpose healthcare FSA will be HSA-ineligible for all of calendar year 2020, even if the FSA balance is spent down to $0.

Another downside consequence to consider is that elections for 2020 calendar-year plans have already been made, so while the relief will reduce and perhaps eliminate FSA forfeitures from 2019, it may result in more 2020 forfeitures than there otherwise would be—the proverbial kicking the can down the road.

About ERISAfire

ERISAfire LLC is an employee benefits compliance services firm, specializing in health and welfare benefits. ERISAfire has reimagined benefits compliance to help agencies and employers manage compliance risks and make the process easier. By leveraging custom-built technology to automate transactional tasks and provide a hyper-customized compliance calendar, its ERISA geeks can focus on complex analysis and experienced ERISA attorneys can scrutinize even the most mundane compliance tasks. Learn more at www.erisafire.com.

Cafeteria Plan Developments: Mid-Year Election Changes

By: David LeFevre, ERISA Attorney + Chief ERISA Geek, ERISAfire Benefits Compliance Solutions

This post examines the recent mid-year election change regulatory and legislative developments from the IRS. For other analyses, see this post on a temporary relaxation of grace period rules, this post on an increase in the maximum healthcare FSA carryover, this post on the repeal of the prescription requirement for over-the-counter items, this post on HSA implications of recent telemedicine developments, and this post on cafeteria plan implications of DOL’s black hole ERISA deadline extension.

Much as it did when it created a mid-year election change event allowing employees to drop employer-sponsored coverage to enroll in state or federal exchange coverage, IRS created five new mid-year election change opportunities out of thin air—meaning they are not found anywhere in Code Section 125. These new mid-year election change events are permissive, not mandatory, so an employer can choose whether and to what extent to allow them.

Current Rule

Ordinarily, Code Section 125 limits mid-year elections to certain events: marriage or divorce, birth or adoption, change of employment, loss of eligibility, change in residence, a change in cost of coverage, improvement in benefits, and entitlement to Medicaid or Medicare, to name a few. Without one of these events occurring (which, in some cases must affect eligibility under the plan), an employee cannot change an existing election until open enrollment for the following year’s elections.

New Rule

IRS Notice 2020-29 gives employers the option of effectively waiving the mid-year election change requirements for five types of prospective election changes. This relaxation of mid-year election change rules, if adopted by an employer, only applies to election changes made during calendar year 2020. The election changes that an employer allows must be prospective, meaning that this guidance does not permit retroactive mid-year election changes, but it can be used to ratify prospective election changes that were technically not permitted but that an employer allowed before the guidance was issued. This ratification effect can only go as far back as January 1, 2020.

New Election Types and Considerations for Each

Add Major Medical

Under the guidance, for the 2020 calendar year, an employer can choose to allow its employees to enroll mid-year in the employer’s major medical plan* when the employee had previously waived such coverage, no questions asked. No reason like loss of other coverage is necessary.

Allowing enrollment in the medical plan when it was waived previously invites adverse selection—that is, employees dropping other coverage that is not as good (or regretting the decision to go naked) in favor of the employer’s richer benefits. For self-insured employers and for claims-credible insured employers, this could have real implications for current claims costs of self-insured plans and for next year’s renewal of insured plans and stop-loss policies, respectively.

In addition, this type of mid-year election change is something that the carrier (be it the stop-loss carrier or health insurance carrier) will likely have to approve before it is implemented. Most policies refer to the Section 125 rules for mid-year election changes, and as mentioned above, this new mid-year election change opportunity is not in Code Section 125.

Finally, the guidance places no limit on the number of times an employee can add major medical coverage using this new mid-year election change event. Conceivably an employee could add medical, drop it under a different election change event and re-add it. Employers are not required to implement this election change at all, and even if an employer does, it can place restrictions on it by, for example, opening a limited window of time.

Change Major Medical Option or Coverage Tier

Under the guidance, for the 2020 calendar year, an employer can choose to allow its employees to change to a different major medical coverage tier, to a different major medical option mid-year, or both, no questions asked. So, for example, an employer could allow an employee to change from employee-only to family or from family to employee-only coverage in a particular major medical option. Similarly, an employer could allow an employee to change from a low-deductible PPO to a high-deductible health plan (HDHP) or HMO. An employer could also allow an employee to change both medical options and coverage tiers.

Allowing employees who are already enrolled to change coverage tiers or coverage options (or both) presents less adverse selection risk than allowing them to add medical coverage that had previously been waived, but it is not void of adverse selection risk. Also, presumably in most cases this will result in employees downgrading to less expensive medical options or tiers, so self-insured employers will wind up collecting less in employee contributions for the same claims risk.

Both stop-loss carriers and health insurance carriers will feel the effects as well, and so the carrier will likely have to approve this election change opportunity before it is implemented. Most policies refer to the Section 125 rules for mid-year election changes, and as mentioned above, this new mid-year election change opportunity is not in Code Section 125.

Finally, the guidance places no limit on the number of times an employee can change medical coverage tiers or options. Employers choosing to implement this election change would be well-advised to put some type of restriction in place—i.e., opening a limited window of time to make a change and/or a limit on the number of times it can be used.

Limited Opportunity to Drop Major Medical

Under the guidance, for the 2020 calendar year, an employer can choose to allow its employees to drop major medical coverage mid-year if the employee provides a written attestation that he/she is enrolled or will immediately enroll in other major medical coverage. The other coverage can be that of another employer or from the Exchange or Medicare/Medicaid or an individual policy.

The attestation requirement adds administrative complexity for employers, and much like the other major medical mid-year election change opportunities it presents some adverse selection risk: healthier employees willing to run the risk may take the opportunity to go naked, providing the insurer or self-insured employer less in premiums from people who present less risk, leaving a marginally riskier population in the plan. Insurers, both stop-loss carriers and health insurance carriers, will likely have to approve this election change opportunity before it is implemented.

This mid-year election change opportunity may be useful as a way to speed up an existing, broader strategy of driving employees to government-sponsored programs or the individual market.

Any Change to DCAP/Dependent Care FSA

Under the guidance, for the 2020 calendar year, an employer can choose to allow its employees to add, drop, increase or decrease their dependent care FSA (dependent care assistance program, or DCAP) elections mid-year, or any combination of those, no questions asked.

Keep in mind that with this guidance IRS is expanding what employers may allow. Employers don’t have to go all-in and can instead choose to only allow election changes under certain circumstances. Allowing employees to change their dependent care FSA/DCAP elections should be narrowly tailored. If, for example, an employer finds it desirable to let people reduce their elections, the permitted reduction should have a floor equal to the amount of reimbursements already made (or that are pending), so that experience losses are kept to a minimum.

Any dependent care FSA/DCAP election changes that an employer decides are worthwhile should first be confirmed with its third-party administrator to ensure it has the capability to implement the change and, if so, confirm the timing of any system changes.

Any Change to Healthcare FSA

Under the guidance, for the 2020 calendar year, an employer can choose to allow its employees to add, drop, increase or decrease their healthcare FSA elections mid-year, or any combination of those, no questions asked. This applies to both limited-purpose and general-purpose healthcare FSAs.

As with the similar mid-year election change opportunity for dependent care FSAs/DCAPs, employers should narrowly tailor the rules to prevent unlimited, perpetual changes. If an employer finds it desirable to let people reduce their healthcare FSA elections, the permitted reduction should have a floor equal to the amount of reimbursements already made (or that are pending), so that experience losses are kept to a minimum.

Any healthcare FSA election changes that an employer decides are worthwhile should first be confirmed with its third-party administrator to ensure it has the capability to implement the change and, if so, confirm the timing of any system changes.

Unaffected Elections

IRS Notice 2020-29 does not impact elections for employer-sponsored coverages of the following types:**

- Vision

- Dental

- Life/Accidental Death & Dismemberment

- Disability

Plan Amendment Requirements

Even if the cafeteria or premium-only plan includes a broad cross-reference to Code Section 125 (e.g., “all mid-year election changes permitted under Code Section 125”), an amendment to the cafeteria plan will be required because these election changes are not actually permitted under Code Section 125. The amendment must be applied prospectively, except to the extent the employer has already permitted prospective election changes that, prior to the notice, were not allowed by Code Section 125.

Footnotes

* The Notice uses the term, “health coverage,” which is not ordinarily the term used to describe any tax-qualified welfare benefits. Rather, the Code and Treasury Regulations typically use “group health,” “accident and health,” “excepted benefits” or some other term. Because the Notice introduces a new term, it is unclear whether “health coverage” includes dental and vision or if it refers only to major medical. In light of the Notice’s reference to “comprehensive health coverage,” we are taking the conservative approach that “health coverage” means major medical coverage and not dental or vision.

** Our inclusion of vision in this list is based on our interpretation of the term, “health coverage,” that is used in the Notice.

About ERISAfire

ERISAfire LLC is an employee benefits compliance services firm, specializing in health and welfare benefits. ERISAfire has reimagined benefits compliance to help agencies and employers manage compliance risks and make the process easier. By leveraging custom-built technology to automate transactional tasks and provide a hyper-customized compliance calendar, its ERISA geeks can focus on complex analysis and experienced ERISA attorneys can scrutinize even the most mundane compliance tasks. Learn more at www.erisafire.com.

Can we change health plans and FSA elections midyear? Should we?

Employers and employees picked up on this NY Times article earlier this week, and many are wondering what that means for their group health and flexible spending plans. The short answer is that any midyear flexibility will require written plan amendments, notification to affected employees, and cooperation from the insurance carriers and third party administrators. One of our TPA partners, BASIC, has provided an excellent high-level summary, which is copied here in full:

From: BASIC Compliance Team

The IRS released Notice 2020-29 and Notice 2020-33 on May 12, 2020 that impacts cafeteria plan administration. The BASIC Compliance team is currently reviewing these Notices and will provide more in-depth practical insight in the near future. Because the issued guidance applies to many of the questions we are receiving daily, here are the highlights:

Mid-Year Election Changes

Health Coverage - Employers may allow employees to make prospective mid-year elections with regard to employer sponsored health coverage. These permissive election changes include: (1) electing previously declined coverage, (2) electing different employer sponsored health coverage, and (3) revoking elections in certain circumstances.

Health FSA and Dependent Care FSA – Employers may allow employees to make prospective mid-year elections to revoke a previous election, make a new election, or change an election (increase or decrease amount).

Unused Amounts in Health FSAs and Dependent Care FSAs

On May 4, 2020, regulations were issued by the Department of Labor's Employee Benefits Security Administration (EBSA) and the IRS providing claims deadline relief (impacting employer sponsored plans subject to ERISA). The regulations require ERISA plans to “disregard” the period from March 1, 2020 through the date that is (60 days) after the end of the “Outbreak Period.” Everyone was left wondering how to apply these regulations to FSAs given the “Use it or Lose it” rule.

Under Notice 2020-29, the IRS clarifies that employers may allow employees to use amounts from their 2019 Health FSAs and Dependent Care FSAs to pay for or reimburse medical or dependent care expenses, respectively, incurred through December 31, 2020. This applies for any cafeteria plan that has a grace period or plan year ending in 2020.

Health FSA Carryover Amounts

For all plan years beginning in 2020, the amount that employers may allow employees to carryover from one plan year to the next will be indexed in step with the maximum salary reduction amount permitted each year. This means that $550 may be carried over from a plan year starting in 2020 to the following plan year beginning in 2021.

Employers wishing to provide these expanded mid-year election changes, extended periods to use amounts in FSAs, and/or increased carryover amounts must adopt plan amendments to the cafeteria plan by December 31, 2020.